Caption: Interactive map presenting country specific data, including universities and incubators contacted for the study and the digital innovations identified at the time of the study

Full country profile (PDF)

South Africa Ranked First out of 16 Countries in the Benchmark

The benchmark assessment reflects the extent to which South Africa is unlocking positive pathways towards a digital economy and supporting a vibrant ecosystem of different actors.

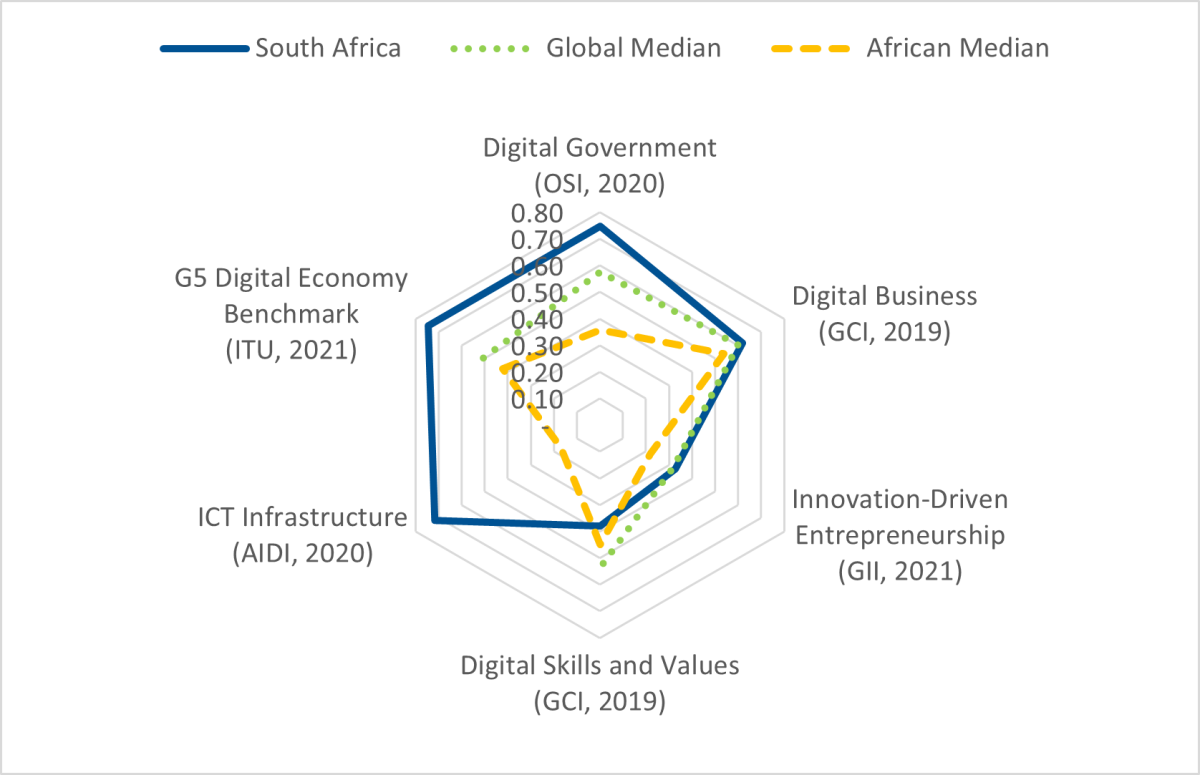

Caption: Results from Benchmark Assessment for South Africa

South Africa ranked 1 of 16 in the benchmark assessment which suggests that it has a robust and mature digital economy which could provide guidance on some best practices.

South Africa ranked consistently in the top two ranking of most of the assessment pillars and surpasses the African and Global median for all pillars except digital skills where it ranked 10.

| Group | Country | Benchmark Index Score (Adjusted) | Overall Benchmark Ranking |

|---|---|---|---|

| 1 | South Africa | 0.5891 | 1 |

| Mauritius | 0.5839 | 2 | |

| Seychelles | 0.5155 | 3 | |

| Global Median | 0.5064 | ||

| 2 | Eswatini | 0.4222 | 4 |

| Tanzania | 0.4138 | 5 | |

| Botswana | 0.4114 | 6 | |

| 3 | Zimbabwe | 0.3895 | 7 |

| Namibia | 0.3809 | 8 | |

| Lesotho | 0.3802 | 9 | |

| African Median | 0.3595 | ||

| Zambia | 0.3506 | 10 | |

| Malawi | 0.3483 | 11 | |

| Madagascar | 0.3005 | 12 | |

| 4 | Angola | 0.2985 | 13 |

| Mozambique | 0.2919 | 14 | |

| DR Congo | 0.2782 | 15 | |

| Comoros | 0.2497 | 16 |

Caption: Overall Benchmark Assessment Results and Rank for all SADC member states

For further information on the benchmark results and regional trends please read the Situational Analysis Report.

South Africa Has a Strong Environment to Encourage Digital Agriculture, But This is Not Accurately Reflected in ICT Plans and Strategies

Digitalization has been whole-heartedly embraced within the policy environment of South Africa. The number of frequent strategies and plans does raise questions around the clarity of the overall vision, potential fragmentation and duplication in departments, and the effectiveness of these strategies.

South Africa likely has a strong environment to encourage digital agriculture, but this is not accurately reflected in their ICT plans and strategies.

If the public sector is not pushing a clear agenda for digital agriculture, then there is the possibility that a lack of integration between farmers and digital solutions will stifle the adoption of technology by smallholder farmers.

57 Innovations were Identified in South Africa

There is a vibrant sub-sector of developing AgriTech with dedicated accelerators, co-working spaces, and investment in South Africa.

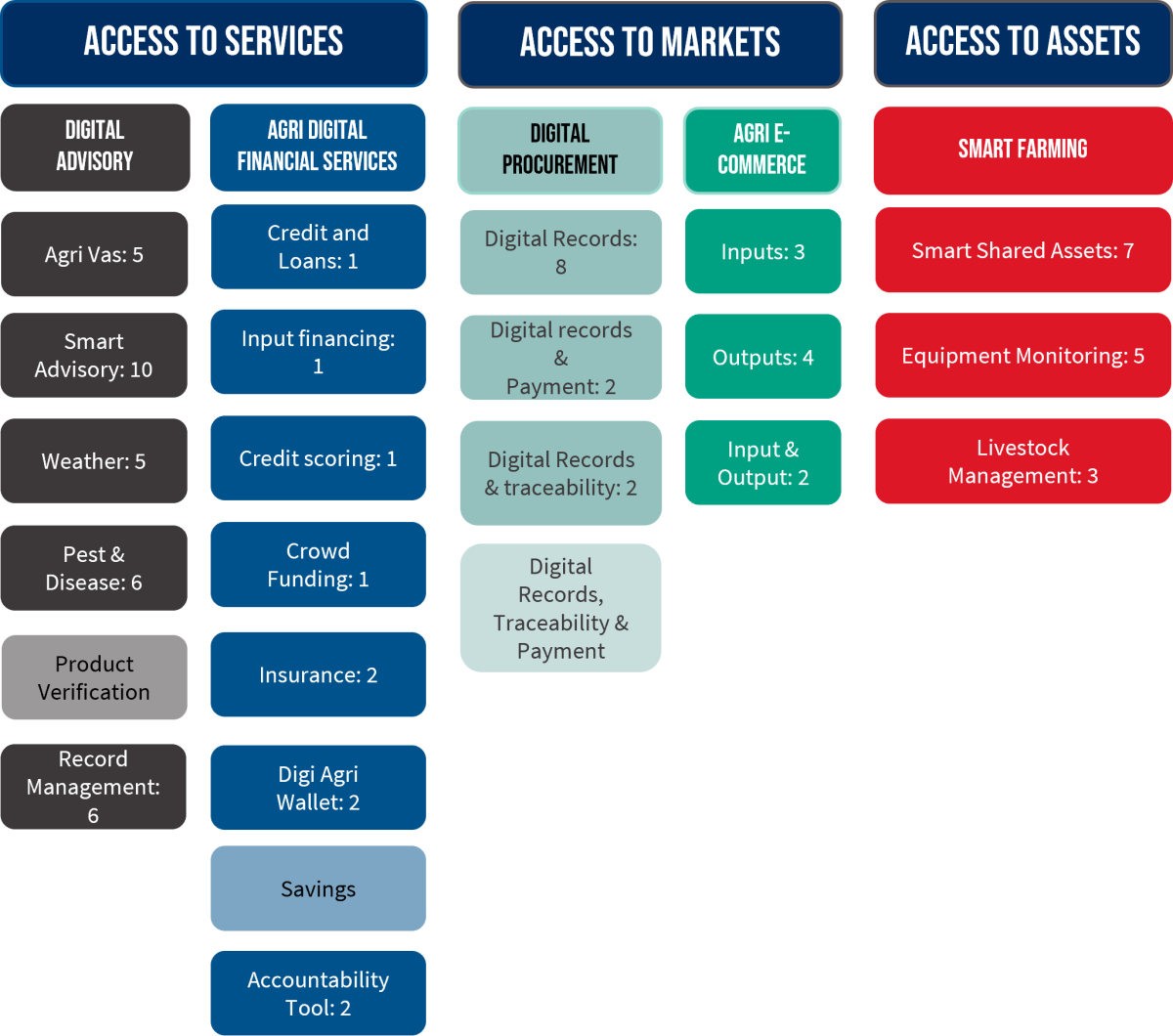

All use cases were present in South Africa, with a high proportion of digital innovations providing digital advisory and digital procurement solutions as well as Agri e-commerce. There were also several examples of Smart Farming solutions.

This trend in Smart Farming and machine learning is in part due to the variety and maturity of South African AgriTech solutions. There are a greater number of AgriTech applications that are targeted towards commercial agriculture.

Caption: Diagram illustrating number of identified innovations and their sub use case solutions.

The greatest proportion of innovations identified were private sector organizations, followed by government. Many of these innovations were launched more recently in the past 3-4 years and covered all aspects of the use cases included in this study.

Innovations in South Africa are present in all stages of the value chain, although storage and transport solutions were the least common.

Caption: Diagram illustrating number of innovations identified in each phase of the value chain.

Whilst most innovations sought to address the knowledge and productivity gap, there were many innovations also addressing access to markets and climate change.

Most of the innovations were at advanced stages of growth, either transitioning to scale or adapting to other geographic regions or wide scale adoption.

The environment for digital entrepreneurship is improving significantly in South Africa but more financial support programs funded by national and provincial governments are needed. Examples of these include grants, industrial innovation awards, and research and development tax incentives.

Digital Agricultural Training and Tools Must Be Integrated into the Curricula of Universities

The potential of digital agriculture in South Africa is huge. Digital skills education is included in the country’s policy framework.

The incubators interviewed seem to acknowledge the importance of digital agricultural entrepreneurship and have integrated digital agricultural tools in their trainings, although it does not seem to be well integrated into the curricula of the Universities interviewed.

An exchange of knowledge and capacity building for universities between the academic sector and the business support organizations is suggested to empower the higher education institutions in preparing youth for the labor market.

Icons - credit to NounProject https://thenounproject.com/